You can earn money quickly through investing in technology companies.

I introduce NASDAQ 100, which represents index investment in US technology companies.

The Nasdaq 100 is an index that tracks the performance of the top 100 non-financial companies listed on the Nasdaq stock exchange. The index was launched in 1985 and is widely regarded as a benchmark for technology stocks and other growth-oriented companies.

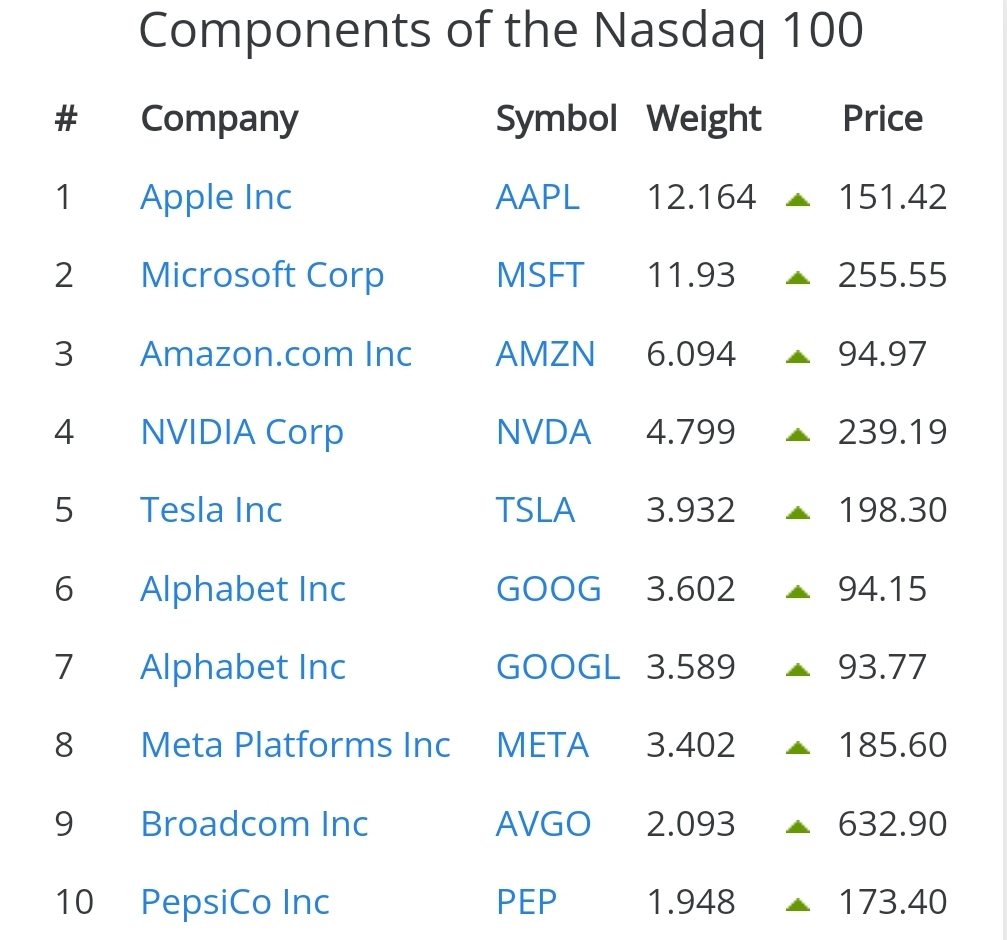

The Nasdaq 100 is a market capitalization-weighted index, which means that the larger the company, the more weight it carries in the index. The index is rebalanced annually to ensure that it accurately reflects the current market capitalizations of the included companies.

The Nasdaq 100 is comprised of companies from a range of industries, including technology, healthcare, consumer services, and industrials. However, the index is heavily weighted towards the technology sector, which accounts for around 60% of the index's total market capitalization.

Some of the most well-known companies in the Nasdaq 100 include Apple, Amazon, Microsoft, Facebook, Google parent company Alphabet, Tesla, and Nvidia. These companies have been at the forefront of technological innovation and have experienced significant growth in recent years, driving the overall performance of the index.

Investors can gain exposure to the Nasdaq 100 through exchange-traded funds (ETFs) that track the index, such as the Invesco QQQ Trust (QQQ) or the ProShares UltraPro QQQ (TQQQ), which offers leveraged exposure to the index.

While the Nasdaq 100 has historically been a strong performer, investors should be aware that the index can be volatile, particularly during times of economic uncertainty or market turmoil. Additionally, the heavy weighting towards the technology sector means that the index is highly sensitive to shifts in sentiment towards tech companies, which can impact its overall performance.